How should advertisers adapt their ad campaigns in a recession?

As the Coronavirus continues to spread across the globe and governments implement stricter measures to protect their citizens, it becomes increasingly clearer that we are heading towards another global recession. While some advertisers might be tempted to decrease their ad spend during these hard economic times, historical data shows that brands that maintain their share of voice during a recession are ultimately able to keep their market share and sell more in the long run.

If you open the business section of your news app these days, you’ll be in for a bit of a fright. Last week brought the biggest one-day plunge since the stock market crash of 1987, with more than 20% wiped off the Dow Jones Industrial Average and S&P 500. The economic turmoil is not just limited to the US: in Europe the FTSE 100, the Cac40 and the DAX are all in the red. Interest rates have been cut in an attempt to prevent the slowdown but, despite efforts from central banks, it seems we’re now heading for a recession.

For advertisers and publishers already reeling from the chaos the Coronavirus has caused, how should they behave in a recession-hit market?

Looking back to past recessions

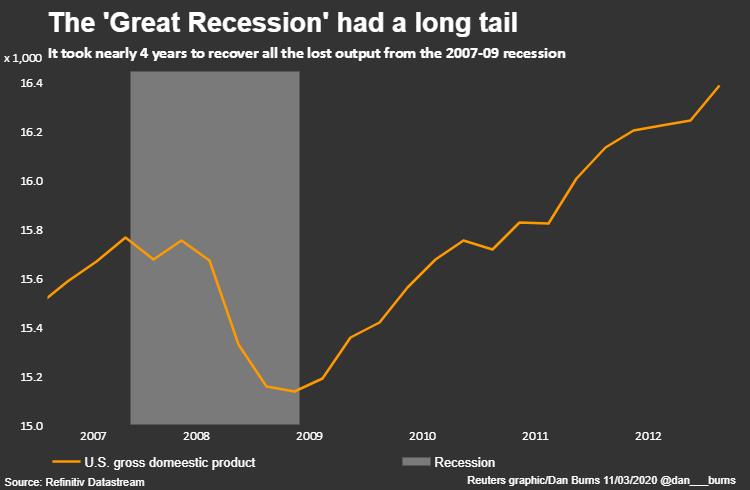

To answer this, we need to hit the history books. Clearly this is not the first time the world has gone through a recession. The most recent – the Great Recession of 2008 – had long-lasting effects on consumer behaviour and resulted in a 9% drop in ad spend globally.

By channel in the US, ad spend fell 27% in newspaper advertising, 22% in radio advertising, 18% in magazine advertising, 11% in out-of-home, 5% in TV and finally 2% in digital.

Despite this, the UK’s Institute of Practitioners in Advertising conducted a report in 2008, in the middle of the Great Recession, which stated: “It is better to maintain SOV (share of voice) at or above SOM (share of market) during a downturn: the longer-term improvement in profitability is likely to greatly outweigh the short-term reduction. If other brands are cutting budgets, the longer-term benefit of maintaining SOV at or above SOM will be even greater.”

And there certainly were winners in the business world at that time. Take Amazon for example. They were able to grow their sales by 28% in 2009, offering new products including the launch of their Kindle line. In fact, on Christmas Day 2009, Amazon customers bought more ebooks than printed books.

This is not the only story of success in the midst of an economic downturn. Kellogg’s is now synonymous with breakfast cereal but back in the 1920s, it was their competitor Post who led in market share. When the Great Depression of 1929 hit, Post reduced their ad spend while Kellogg’s doubled theirs, and they brought out a new product featuring characters Snap, Crackle, and Pop. No need to guess which rival won that particular war – Kellogg’s saw their profits rise 30% and became the market leader in breakfast cereals.

The Coronavirus recession

With that in mind then, just how might advertising be affected by a recession in 2020?

In the Great Recession of 2008, while there was a drop in ad spend, the budget that was spent went in large part toward TV. In the US, for example, the big 4 broadcasters (ABC, CBS, NBC and Fox) pulled in $8.9 billion in advance commitments in 2008-9. Advertisers shouldn’t necessarily rush to up their TV budgets in 2020. After all, the world has changed in eleven years and the market has splintered, with people consuming content on streaming services as well as traditional TV. It would be unwise for advertisers to expect the same results they saw from their TV ad campaigns in 2008-9.

If not TV, what else should brands consider? In tough economic times, the typical trend is for marketers to pull brand awareness budget and push what little money they can spare into performance marketing. The reason for this is simple – they need to prove ROI to their leadership and justify their spending.

Digital advertising is likely to be a key candidate for marketers looking to make quick sales, as nearly everything can be tracked, measured and optimized. And given that in a recession, the cost of advertising tends to fall and spare inventory is usually available, digital advertising could provide an exciting opportunity for brands who are brave enough to maintain ad spend and aggressively compete for market share.

Digital advertising – an opportunity for advertisers

It’s worth noting that we’re no longer in the Great Recession of 2008 when digital advertising was still relatively immature. Instead the industry is much more advanced, with innovative, engaging forms to attract customers.

Why is this important? Well, there are two strategies for advertisers looking to win customers in a recession. The first is to slash prices, leading to a race to the bottom with your competitors.

The second is to explain why your product might cost more and to explain the value. That means being able to tell your brand story. In the past, advertisers ran towards TV, but these days rich media provides a cost-effective, creative way to engage customers.

Think back to 2008. Rich media then was clunky, overly heavy, and expensive. These days rich media can enable you to tell your brand story effortlessly, at at the same affordable rates you pay for static ads. At Nexd, we have a huge range of ad formats for you to work with that require no code writing whatsoever. Plus we optimize all assets with no discernible loss in quality, meaning faster load speeds and a better user experience for consumers viewing your ads.

We also know how important ROI, is so in our Campaign Manager you can get a deeper understanding of how your audience is interacting with your campaigns using real-time analytics.

Clearly 2020 has not started in the way that many of us expected, and there are certainly difficulties that advertisers will have to overcome to maintain sales as the Coronavirus continues to put the brakes on the global economy. However, we do not believe this is a time to reduce ad spend.

On the contrary, this is a time to reassure customers of your company’s stability, to maintain your share of voice. And for brands who are bold and creative enough, it could even provide an opportunity to re-position themselves, launch a new product, and win market share from their competitors.